The cryptocurrency bear market has had a domino effect on not only traders and miners, but the companies that manufacture the necessary hardware to validate transactions on the blockchain. One such company is Nvidia which is also listed in the US Stock markets.

55% Drop in Value in 3 Months

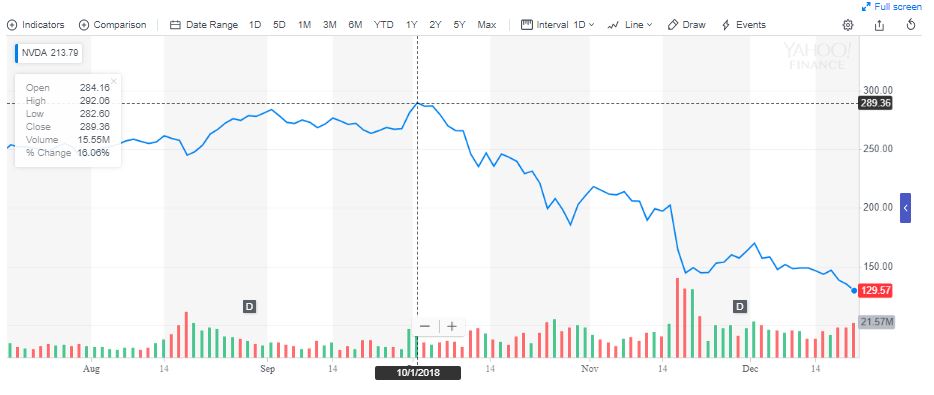

Three months ago, on the 1st of October, NVDA stock was valued at $289 a piece. The same asset is now valued at $129 indicating a 55.4% drop in value in a three month period. A chart from Yahoo Finance has been provided below for a better visualization of its market performance in the aforementioned time period.

According to CNBC, Nvidia had a meteoric rise from early 2016 up until September this year. Its market capitalization increased from $14 Billion to $175 Billion in the same time period. This was attributed to the demand of its fast and efficient GPUs (Graphic Processing Units) that are ideal for artificial intelligence and cryptocurrency mining.

Crypto Bear Market Hits Hard

However, in the last three months, investors have sold NVDA stock due to the crypto bear market which has resulted in a decreased demand for crypto mining hardware. With the value of BTC going below the cost to mine each individual Bitcoin – $6,000 – $7,000 – many miners have had to rethink their strategies or even shut down completely.

NVDA’s drop by over 50% also makes it the worst performer on the S&P 500 index. This index is a market-capitalization weighted index of the 500 largest publicly traded companies in the United States.

Nvidia CEO Jensen Huang had this to say after the firm’s latest earnings report.

The crypto hangover has left the industry with excess inventory – excess channel inventory.

The US stock market has also been hit hard by the recent Fed Rate increment.

Similar Woes by Bitmain

Bitmain has also being going through a similar decline in demand for crypto mining hardware due to the bear market. In the case of Bitmain, there is also the added factors of financing the November Hash Wars as well as rumors of the firm making $740 Million in losses in the third quarter of 2018.

What are your thoughts on the 55% drop in value of Nvidia’s stock price? Please let us know in the comment section below.

[Feature image: a GeForce RTX 2070 GPU. Source, Nvidia.com]

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.