Bitcoin To Hit Six-Digits In Next Bull Run

The Bitcoin (BTC) and cryptocurrency space is full of great minds. When you’re dealing with a revolution in technology and money, this shouldn’t be surprising. But what is surprising is the models and metrics that investors have used to determine “fair valuations” for digital assets, especially BTC.

Trace Mayer, one of the earliest public Bitcoin investors (like 2010 early) and an investor in crypto exchange Kraken, recently took to Twitter to state that “crypto winter” is now over. In fact, Mayer accentuates that with the block reward halving being under one year out and with Bitcoin transaction fees being non-elastic, he is sure that the next rally in this nascent market will “blow your hair back”. In fact, the investor states that Bitcoin could easily hit anywhere from $100,000 to $250,000 in the next bull rally.

But what is Mayer referring to, and does that model have any credibility in the slightest? Well, if you look at the numbers and other sets of cold, hard data, you might just think so.

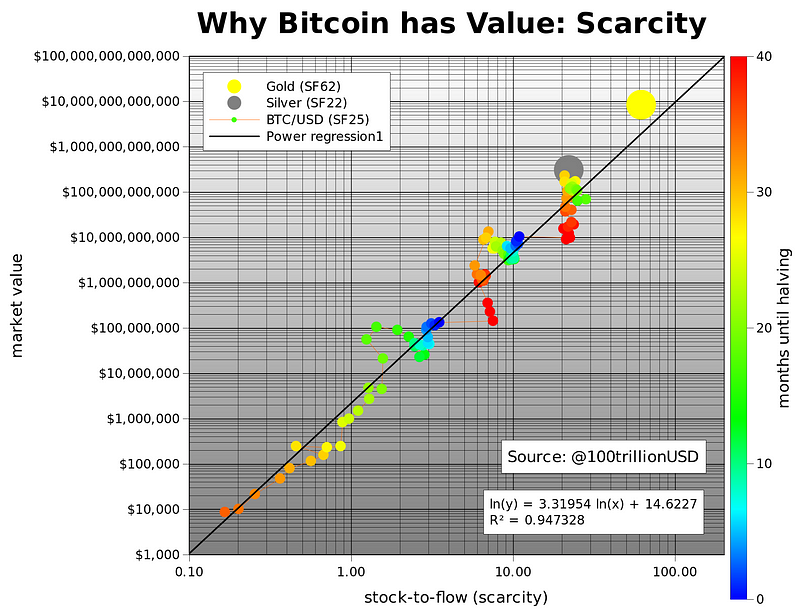

What Mayer is referring to is the stock to flow (SF) ratio, popularized by Saifedean Ammous, the author of industry primer “The Bitcoin Standard”, and Twitter statistician PlanB. In the book, Ammous brings the concept of SF to the cryptocurrency space, which many see as the best way to value “hard monies” like gold and Bitcoin. Just a quick aside: an SF is a ratio between an asset’s above ground supply and how much is being produced/issued each and every year.

PlanB recently determined that the SF ratio of an asset is linked to its market capitalization. As can be seen in the image below, the higher the SF ratio, the higher the value of the asset. The thing is, the correlation between SF and price is exponential, meaning that a marginal increase in the former can cause a large spike in the latter. As it stands, Bitcoin’s current SF is approximately 25, making it understandable that it is valued around the same as silver. With the next halving though, Bitcoin’s SF will begin to approach that of gold. More specifically, BTC’s SF will move from 25 to 50. If this theory holds up and if demand for the cryptocurrency stays the same or increases, BTC should begin to approach the value of gold.

The model states that Bitcoin hitting a $1 trillion market capitalization, which translates to approximately $55,000 per coin, after 2020’s halving event is entirely possible. So no, maybe $250,000 isn’t inbound just yet, but by the next halving, maybe so.

Is $250,000 Possible?

Regardless, some are entirely sure that $250,000 a coin is entirely possible for the cryptocurrency. As Ethereum World News reported previously, analyst Galaxy, claims that Bitcoin’s current monthly chart looks eerily similar to that seen in late-2015, when BTC finally began to embark on a rally yet again.

This is notable, as the last time BTC’s chart structure looked as it did now (a massive green candle after ~one year of selling pressure), what followed was a 6,500% price surge in a two-year time frame. Thus, Galaxy notes that if historical precedent is followed to a tee, a bull run of the previous one’s magnitude will place BTC at over $333,000 per unit by the end of 2021.

Photo by Kent Pilcher on Unsplash