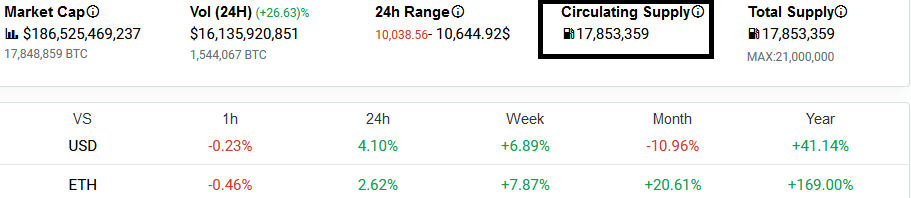

As we near the next Bitcoin halving event, only 15 percent of the 21 million BTCs are left to be mined. Now, miners are scrambling for the remaining scarce coins estimated to be 3.2 million.

As per the Bitcoin emission code, these will take more a century to mine. The last BTC will be mined in 2140. Interestingly, 85 percent of Bitcoins were mined and spend in 11 years. Another key point to realize is that in the whole of 2018, only five percent of Bitcoins were mined. In January 2018, the total amount of mined Bitcoins stood at 80 percent.

One Block, 10 Minutes, 12.5 Bitcoins

The Bitcoin network approves a new block after every 10 minutes depending on difficulty. For each confirmed block, the miner earns 12.5 BTCs. However, with the halving event set and projected for May next year, the successful miner-often mining pool- will be pocketing 6.25 BTCs for every new block.

Miners are individuals or groups who contribute to the security of the chain by supplying computer power, that is, hash rate. In turn, the network incentive the pool, made up of individual miners, with these scarce coins.

The halving event, which is hard-coded into the Bitcoin blockchain, occurs every 210,000 blocks. Expected, when there is a reduction in rewards, miners may abandon the Bitcoin blockchain leaving it open to attacks.

However, to counter this effect, the price of Bitcoin tends to be re-priced higher, overshadowing the possible losses of reduced rewards. In a natural correction determined by supply-demand dynamics, the resulting scarcity will draw demand for the asset and the shortfall in BTCs received from every confirmed block will be covered better prices. Additionally, the drop in rewards may be compensated by a rise in the transaction fees on the Bitcoin blockchain.

Currently, the most compelling evidence so far points to an increase in the transaction fees. For example, the transaction fees on the Bitcoin network are reportedly at $500 million. These fees are hovering around $1.50 per transaction. However, there are times when they spike to $6, mostly depending on the network activity. The busier the Bitcoin network, the higher the propensity that miners will charge higher prices to approve transactions.

Bitcoin Demand from Cash App

Perhaps highlighting how investors are accumulating in expectation of a rally by Q2 2020, , BTC purchases on Square’s Cash App more than doubled.

In a tweet, a Bitcoin diehard, Kevin Rooke, said:

“Square customers bought $125 million of Bitcoin last quarter on [Square’s] Cash App! That’s 5 straight quarters of accelerating revenue growth for Square’s Bitcoin business, and 237% growth YoY [Year over Year].”

In its second-quarter earnings report, Square, a payments firm founded by Jack Dorsey, announced that its Bitcoin-focused Cash App drew $125 million in revenue.

According to Square, through a letter to shareholders:

“In the second quarter of 2019, Cash App revenue comprised of $135 million in subscription and services-based and transaction-based revenue, and $125 million in Bitcoin revenue. During the quarter, Bitcoin revenue benefited from increased volume as a result of the increase in the price of Bitcoin, and generated $2 million in gross profit.”

It’s important to realize that the gains made in Q2 tramps those made in Q1. For instance, in Q1, Square reported a revenue and profit of $65.5 million and $832,000, respectively. Interestingly, in the whole of 2018, Square reported Bitcoin sales volume of $166 million.

Square’s Cash App is available on both iOS and Android-powered mobile phones. In June, it added support for direct Bitcoin deposits. Previously, Cash App’s users were only able to sell, purchase, and transfer Bitcoin to other wallets.